You Are Not Broken. The System Is.

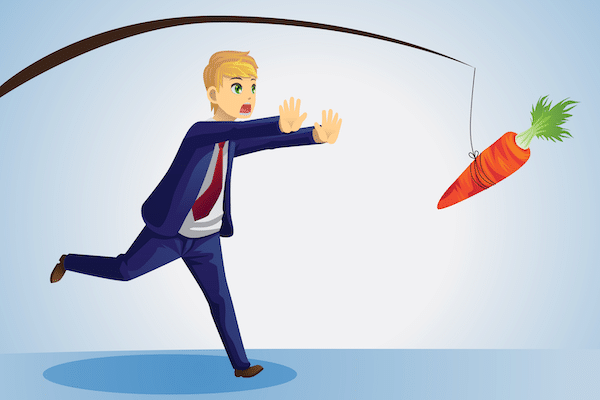

Expose the rigged game. Remove shame. Start fresh.

Let’s clear something up right out of the gate: you are not the problem.

Yes, your bills might be stacked like pancakes at a Sunday diner. Yes, you might dread checking your bank account. But before the shame spiral kicks in again, take a look around.

This isn’t just about you.

It’s about a debt-based economy designed to keep people spending money they don’t have to buy things they don’t need, to impress people who don’t matter—financed by banks that literally create money out of nothing.

No, really. Nothing.

When you swipe your card or sign a loan document, the bank doesn’t open a vault and hand over a pile of twenties. They create a digital IOU on the spot. That IOU becomes your debt. Their asset. They then charge you interest for the privilege of being in the hole.

It’s a brilliant system. For them.

For you? Not so much—unless you start flipping the rules in your favor.

So how did we get here?

Short version: In 1971, Richard Nixon took the U.S. off the gold standard, which basically meant the dollar no longer needed to be backed by anything real. From that moment on, debt became the new gold.

Consumer credit cards exploded. Mortgage markets ballooned. Student loans became an industry. By the time you were old enough to rent a car, you were already being sold on credit like it was some patriotic rite of passage.

And if you fell for it? That’s not stupidity. That’s programming.

The good news?

There’s a way out. But it doesn’t start with credit repair scams or lottery tickets or praying the Fed cuts rates again so your credit card APR drops a half point.

It starts with knowledge. And not the kind peddled by talking heads in $5,000 suits who think inflation only matters when champagne costs more.

We’re going to talk real history. Real money. Real people.

You’ll learn how to:

- Understand why you’re in debt (hint: it’s not just “bad choices”)

- Use the same debt system for rebuilding wealth

- Spot traps designed to keep you in financial chains

- Build something real—even if you’re starting from below zero

Because let’s be honest: it’s hard to grow seeds of wealth when your soil’s been salted by compound interest.

But it can be done.

And in the weeks to come, we’ll show you how.

Coming Next:

“The Great American Credit Trap (and How to Disarm It)”

How the game is played… and how to stop being the house’s favorite customer.

I love reading the articles I learn something new every time