Random Crypto Texts

Ever Have a Rando Contact You and Bring Up Buying Cryptocurrency?

If you’ve ever gotten a random text that says something like, “Hey, is this Alex? We met at the wine tasting,” you’re probably not just the victim of a wrong number — you’re the target of a pig butchering scam. No, it’s not some rustic culinary tradition. It’s a sinister, slow-cooked con where scammers reel you in with charm, romance, and fake investment advice — then carve your bank account like a holiday ham.

Here’s how it works: a message pops up on your phone via WhatsApp, Signal, Instagram DMs, or even just a regular text message. The sender is often a strikingly beautiful man or woman with a suspiciously professional headshot, someone who seems a little too into you for having just mistyped a number. They apologize for the “mistake,” but then — what luck! — they’re delighted to have met someone as kind and interesting as you. Soon, casual conversation turns into digital courtship. They start dropping hints about their success in crypto trading and offer to “show you the ropes.” How romantic.

This isn’t just a phishing expedition — it’s a full-blown emotional con job, laced with all the hallmarks of a romance scam. Flirting, daily check-ins, compliments, even talk of meeting in person or building a future together. The goal is to lower your guard while raising your trust. They’ll show you doctored screenshots of profitable trades and link you to a slick-looking (but entirely fraudulent) trading platform. You “invest,” see fake profits, and are encouraged to “grow your portfolio.” And just when you’re hooked, the butcher’s knife comes down — the money disappears, the website goes dark, and your charming crypto coach vanishes like a Snapchat message.

What’s made this even more dangerous recently is the rise of AI chatbots. These scammers no longer need to man every conversation themselves — they can let AI do the schmoozing 24/7. The bots are eerily good at mimicking human speech, showing interest, responding to emotional cues, and even peppering in emojis and inside jokes. It’s a scammer’s dream: scalable, believable, and exhausting for real humans to detect. You’re not just talking to a scammer — you’re talking to an algorithm trained to steal your trust and, eventually, your money. Using AI they can make a believable fake person or just steal pictures of a pretty face from social media.

So, if you get a message out of the blue from someone attractive, chatty, and overly interested in your financial future, be warned: you’re not being discovered, you’re being fattened up. Politely decline, block, and resist the urge to believe a modelesque stranger wants to talk crypto over cocktails with you. They’re not your soulmate — they’re your scammer.

✅ Final Thought

At Dealing With Debt, we believe that protecting your financial future means staying informed, aware, and supported—especially in a world where scams are evolving faster than ever. That’s why we provide guidance, community insight, and practical tools to help you stay safe, reduce financial stress, and build a more stable future—one budget at a time.

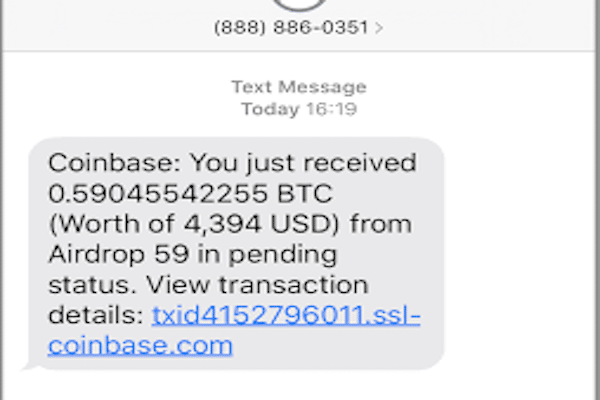

One scam I’ve seen a lot on social media is when celebrities or public figures offer to send free cryptocurrency. Sadly, many people fall for it.